John Buck Acquires West Loop Development Site

Chicago developer John Buck has taken a key step forward in his plan to build a two-tower office building in the West Loop, buying the site he is eyeing for the project despite tough times for downtown office landlords. A Buck spokeswoman said the firm recently...

JBC and 3MR secure $34M loan

Co-developers 3MR and The John Buck Company have secured a $34-million loan for the construction of a mixed-use housing development in Culver City, reports the L.A. Business Journal. The $210-million project, which was approved earlier this year by Culver City...

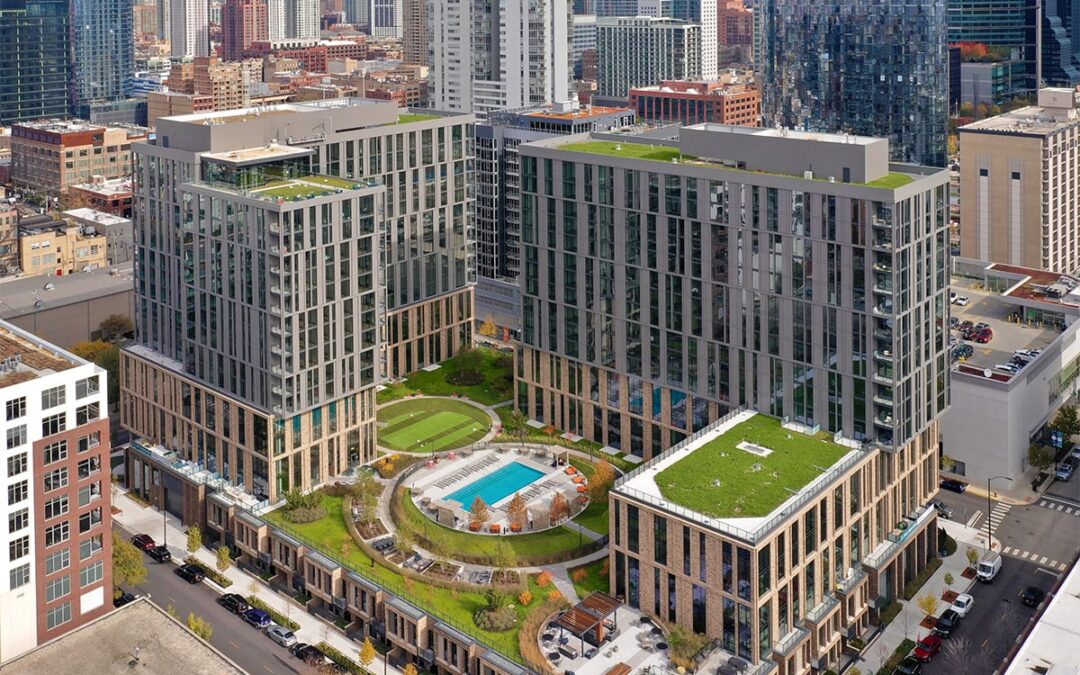

Porte Awarded Multifamily Development of the Year

Lendlease Development, along with co-developer The John Buck Company and partner Intercontinental Real Estate Corporation, today announced that Porte has been named Multifamily Development of the Year by REjournals. The two-tower, mixed-use project beat out four...

John Buck Co., Element Properties Break Group on 86-Unit Apartment Community in Boulder

BOULDER, COLO. — Chicago-based The John Buck Co. and Boulder-based Element Properties have broken ground for Platform, a multifamily property within S’PARK, a 6.8-acre mixed-use, mixed-income multifamily development in Boulder. Situated on 1.2 acres at 3350 Bluff St.,...